Property Tax FAQ

About Your Property Tax

Click to Enlarge(JPG, 155KB)

Click to Enlarge(JPG, 79KB)

When are my taxes due?

Property taxes are due November 30th and May 31st of each year. Because these dates fall on Sunday this year, the first-half payment is due on December 1, 2025, and second-half payment is due on June 1, 2026. Only half or full payments can be accepted. Partial payments are not acceptable.

Where do I pay?

Payments may be mailed to:

Lewis and Clark County Treasurer's Office

Rm# 113

316 N. Park Avenue

Helena, Montana 59623

To ensure accurate posting, please include the appropriate payment coupon for each property.

You may also stop by our office to make payment. We are located on the main floor of the City/County Building, 316 North Park, Helena, Montana. Office hours are 8:00 a.m. to 5:00 p.m., including the noon hour.

Property tax payments can now be made with credit cards. You may dial toll free 1-800-272-9829 or make payments through the Internet at www.officialpayments.com. When making payment you will be prompted for your property identification number geo-code number and a jurisdiction number. The jurisdiction number for Lewis and Clark County is #3602.

What if I am unable to pay my property taxes?

In accordance with Montana Law, property taxes that are delinquent are assessed a 2% penalty and interest charges are incurred at the rate of 5/6 of 1%, per month. To ensure the correct amount of your payment, please contact the property tax department at 406-447-8329.

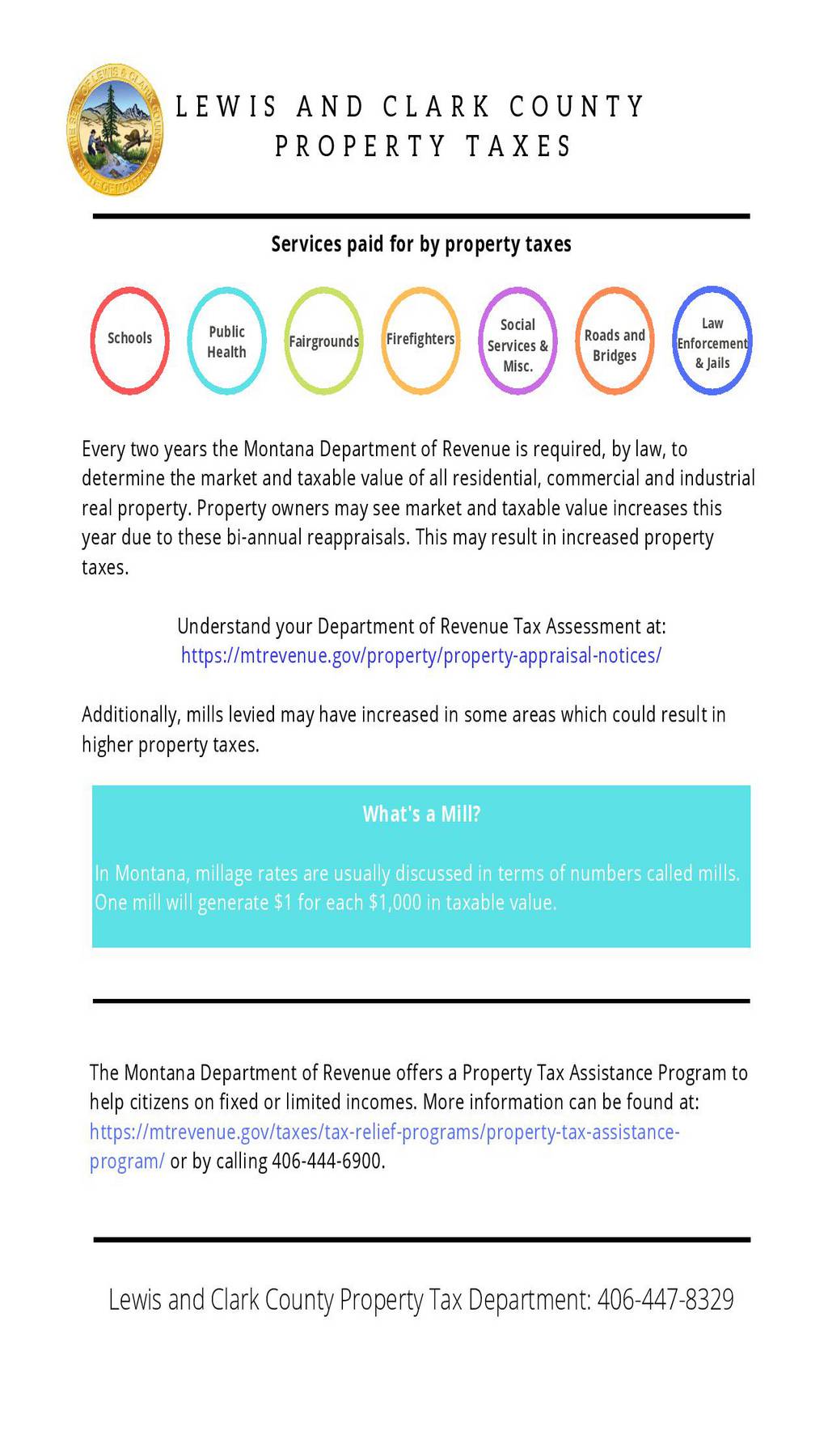

The Montana Department of Revenue offers a Property Tax Assistance Program to help citizens on fixed or limited incomes. More information can be found at https://mtrevenue.gov/taxes/tax-relief-programs/property-tax-assistance-program/ or by calling 406-444-6900.

How are the taxes determined on my property?

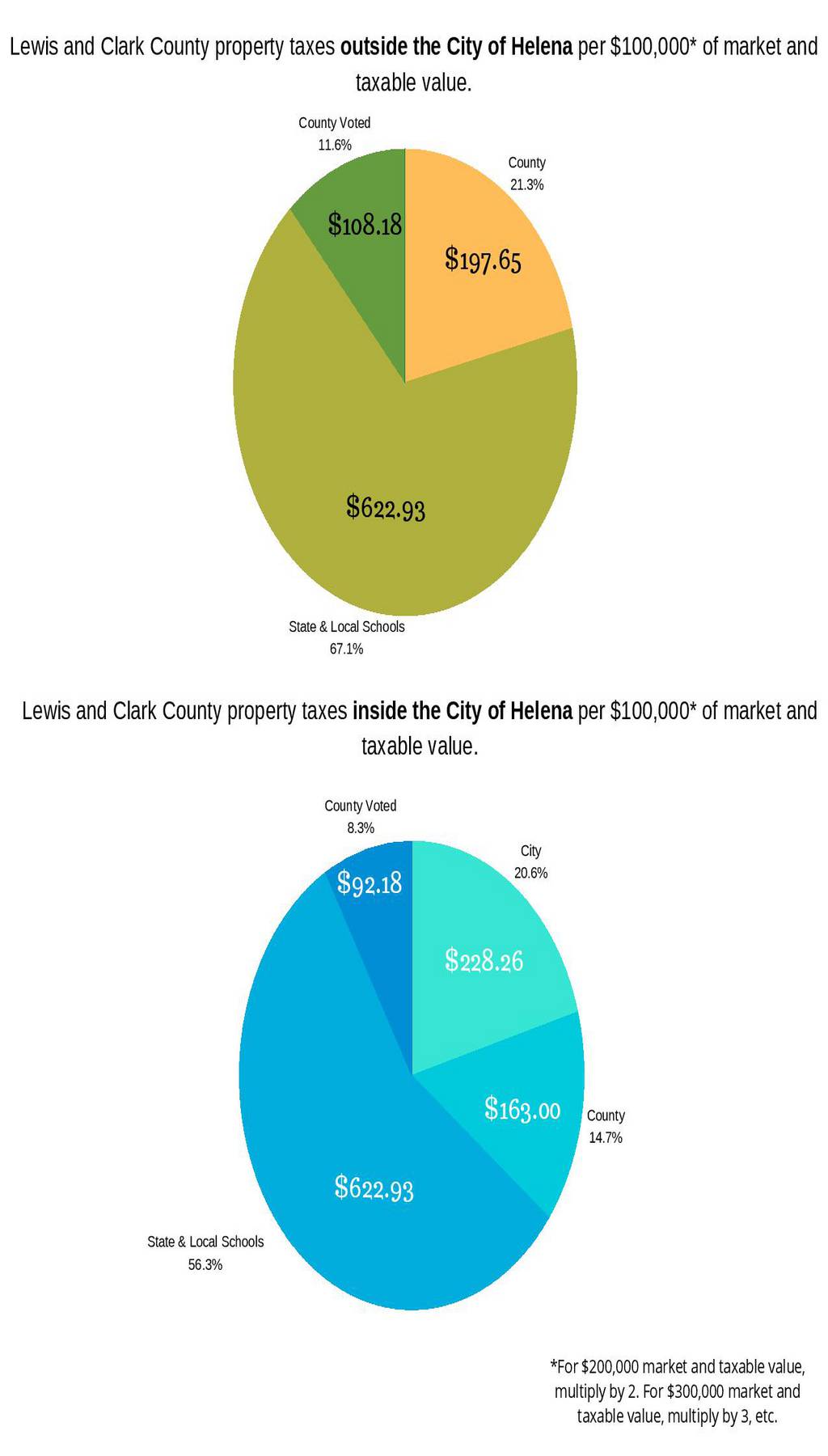

The amount of taxes payable annually on a property is the result of the assessment process and the total mill levies for the taxing authorities that provide public services.

The Montana Department of Revenue establishes the value of all property for tax purposes. The taxing authorities use the assessed value to determine their mill levies. A mill is 1/10th of a penny or $1.00 revenue for each $1,000 of assessed valuation. Information concerning the tax levy can be obtained by contacting the governing boards of the taxing entities.

Information concerning assessments and appraisals can be obtained from the Department of Revenue at 406-444-4000.

Why do I have to pay property taxes?

Taxes pay for local government services. Your tax money supports and provides for the following:

- Schools

- Fire Protection

- Law Enforcement

- County and City Roads

- Community Corrections/Court Systems

- Water/Sewer/Cemetery Districts

- Public Libraries

- County Parks

- Public Health

- Social Services

What is "real" and "personal" property?

Real Property is considered to be permanently fixed in nature (land and improvements on the land). Improvements include all structures, buildings, fixtures and fences. Personal Property is generally a portable or moveable item such as equipment or furniture used in the production of income.