What to know about Property Tax Bills

Published on April 10, 2024

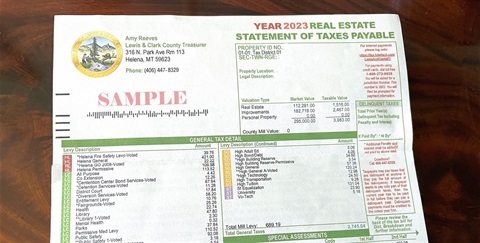

Property tax bills for 2023 were affected by the Montana Supreme Court decision in Lewis and Clark County and many other Montana counties. The counties affected have been ordered to bill out the additional 17.3 school equalization mills and forward those tax dollars to the State of Montana.

Lewis and Clark County will be mailing out revised and supplemental bills this April, with 2nd half tax bills due May 31st. Property owners will see three possible scenarios.

Revised tax bills will be mailed out to property owners who’s second half taxes are still owing. Please note if the first half taxes are still owing, penalty and interest will apply.

Supplemental tax bills will be mailed out to property owners who have already paid their first and second half tax bill.

Original tax bills will be used to pay the second half taxes for those who own property with a very low market value. Resolution 2024-19 was passed to not bill property owners if the additional 17.3 mills calculate to less than $5.

We suggest contacting your mortgage/escrow company after you receive your revised or supplemental tax bill to confirm if they are making this payment on your behalf.

Here is an estimate of what the extra 17.3 mills will cost for a residential property.